'Changing Dynamics': EU Legislation Shifts Coffee Industry Landscape Amid Forest Conservation Efforts

In Buon Ma Thuot, Le Van Tam navigates the complex world of global trade, well aware of its influence on the fortunes of small-scale coffee farmers like himself.

His journey with coffee cultivation began in 1995 on a piece of land near Buon Ma Thuot city in Vietnam's Central Highland region. Initially, his focus was solely on maximizing yields, prioritizing quantity over quality. Employing hefty doses of fertilizers and pesticides, Tam's success was tethered to fluctuating global prices.

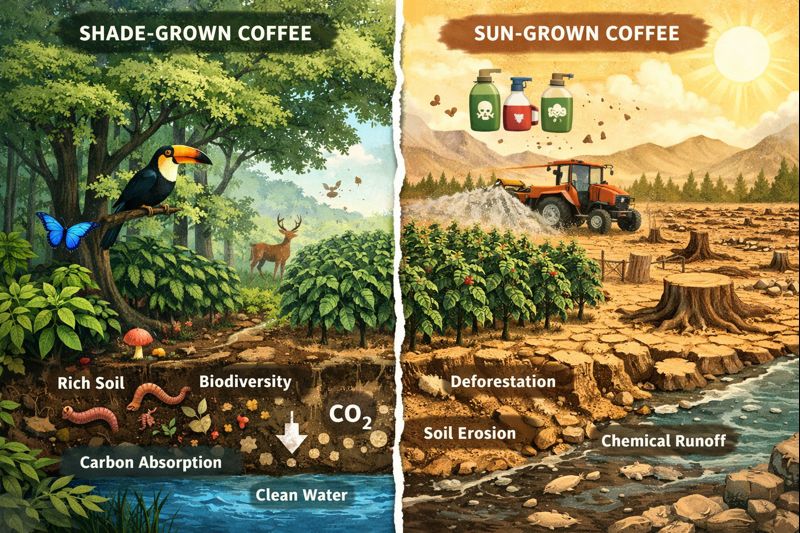

However, in 2019, a partnership with Le Dinh Tu of Aeroco Coffee altered his approach. Embracing more sustainable practices, Tam transformed his coffee plantation into a vibrant ecosystem resembling a sunlit forest. Intertwined with tamarind trees providing essential nitrogen and black pepper vines, his coffee now thrives amidst a diversity of flora. This shift not only maintained his output but significantly enhanced the value of his product.

During the 1990s, Tam was one among thousands of Vietnamese farmers who capitalized on soaring global coffee prices, leading to the cultivation of over a million hectares of coffee, predominantly robusta. By 2000, Vietnam had emerged as the world's second-largest coffee producer, contributing substantially to its export revenue.

Vietnam anticipates that farmers like Tam will reap the benefits of a potential restructuring in the coffee trade, driven by stringent European regulations aimed at curbing deforestation.

The European Deforestation Regulation (EUDR), effective from December 30, 2024, prohibits the sale of products, including coffee, without proof of non-involvement in deforestation. Extending beyond illegal logging, this regulation encompasses a wide array of commodities such as cocoa, soy, palm oil, and more. Large corporations must furnish evidence demonstrating compliance with non-deforestation practices since 2020, while smaller entities have until July 2025 to comply.

Recognizing deforestation as the second-largest source of carbon emissions globally, Europe aims to address this issue by regulating imports. Helen Bellfield, a policy director at Global Canopy, emphasizes the potential of EUDR to significantly reduce deforestation, provided it establishes a new standard for product traceability.

Nonetheless, Bellfield acknowledges potential loopholes where companies might divert non-compliant products to other markets, leaving numerous small-scale farmers without access to stringent compliance measures. The effectiveness of EUDR depends heavily on national support systems ensuring traceability for smaller producers.

Already, repercussions are evident; orders for Ethiopian coffee have dwindled, highlighting the challenges faced by countries lacking robust systems for compliance. Amidst these concerns, Vietnam, heavily reliant on coffee exports, is swiftly preparing for the regulatory shift, leveraging national initiatives to bolster traceability within its coffee-growing provinces.

Embracing the inevitability of change, Vietnam's agriculture ministry is spearheading efforts to promote sustainable practices, aligning with the principles driving EUDR. Minister Le Minh Hoang envisions EUDR as a catalyst for accelerating sustainable transformations in the agricultural sector.

For entrepreneurs like Tu and Tam, adaptation is imperative. Despite potential cost escalations, Tu underscores the value of prioritizing quality to secure better market prices, viewing it as a means to transcend labor-intensive practices.

Tu's proactive approach includes acquiring sustainability certifications from international agencies, a crucial step towards compliance with EUDR standards. However, ensuring compliance among Vietnam's vast network of small-scale farmers presents formidable challenges, necessitating innovative solutions for data collection and verification.

Brazil, with its well-organized supply chain and significant coffee plantations, appears better equipped to navigate the regulatory landscape. Recognizing the disparities, EUDR offers extended timelines and pledges support for vulnerable stakeholders, particularly smallholders and Indigenous communities.

In contrast, countries like Peru and Ethiopia grapple with infrastructural limitations and bureaucratic hurdles, hindering effective compliance. Ethiopia, in particular, faces mounting uncertainties as doubts persist over its capacity to meet EUDR requirements, prompting fears of declining orders and potential market diversions.

As the coffee industry braces for transformative regulatory shifts, stakeholders across the globe confront a paradigm shift. While the road ahead may be fraught with challenges, the pursuit of sustainability remains paramount in safeguarding the future of coffee farming communities worldwide.